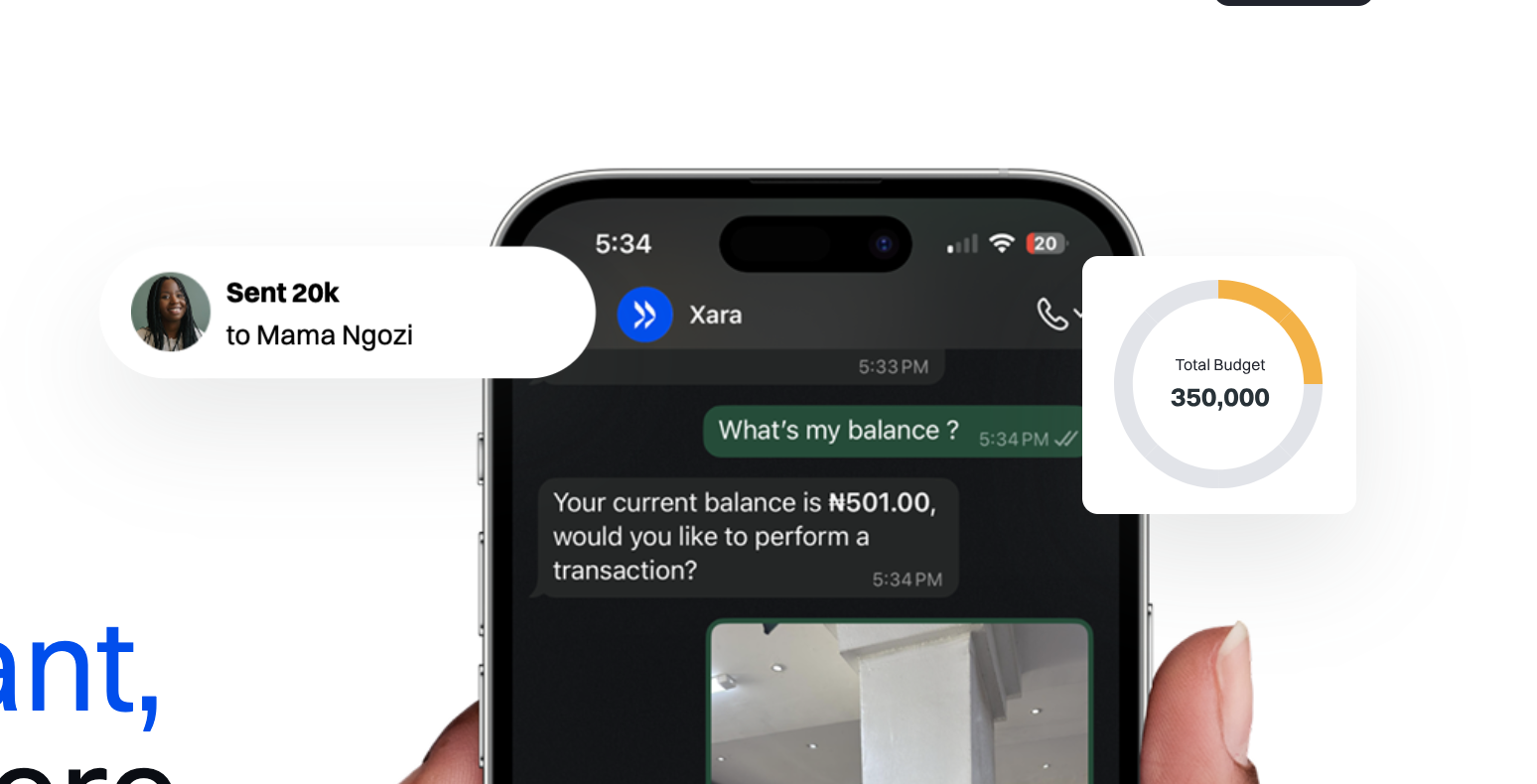

In a country where most people already live inside WhatsApp, Nigerian software engineer Suleiman Adewale is turning the chat app into a bank teller. His product, Xara, is a multimodal AI assistant that lets Nigerians send money, pay bills, and track spending by texting or voice-noting in plain language—no new app, no learning curve.

The Big Idea

Adewale’s thesis is simple: remove friction, meet people where they already are. With WhatsApp reportedly the default messenger for the vast majority of Nigeria’s 31.6 million social media users, Xara converts everyday chats into executable financial instructions:

• “Send ₦10,000 to Abubakar for breakfast.”

• “Pay my PHCN bill on Friday.”

• Snap a photo of an account number and say, “Transfer this.”

Xara parses the message, confirms the details, and processes the transaction in real time. It saves beneficiaries, schedules payments, and can summarize where your money went this week—all inside one WhatsApp thread.

Under the Hood

Xara runs on a large language model fine-tuned for Nigeria:

• Languages: English and Nigerian Pidgin today; Hausa and Yoruba in development.

• Inputs: text, voice notes, and images (e.g., a photographed account number).

• Banking rails: users are issued account numbers via 9 Payment Service Bank (9PSB) at onboarding, with broader bank partnerships in the pipeline so customers can choose their primary bank.

“We chose WhatsApp because it’s the one digital habit grandparents and Gen Z share,” Adewale says. “If banking feels like chatting with a friend, adoption follows.”

Early Traction and Growing Pains

Within two weeks of launch in June, Xara onboarded ~10,000 users and processed ~₦135 million in transfers, according to Adewale. Demand spiked fast enough that the team briefly paused new registrations while upgrading payment partners and capacity.

On the ground, use cases are practical. A restaurant server in Ilorin describes ditching wall-posted account numbers: “If Xara can read a photo and transfer instantly, it saves time for us and customers.” Power users like the ability to set-and-forget bills or ask for a spending digest in natural language.

Security, Privacy, and Trust

Convenience raises a predictable question: Is it safe?

• Encryption: Chats ride on WhatsApp’s end-to-end encryption.

• Auth: Transfers require a 4-digit PIN; users are urged to lock WhatsApp or the specific Xara chat with Face ID/password.

• Data policy: Xara says it doesn’t store card or sensitive banking credentials; it logs only transaction metadata for reconciliation.

• Account recovery: If a phone is lost or a WhatsApp account is compromised, users can request an instant freeze and reinstate after ID checks.

On regulation, Xara currently operates under partner licenses while it formalizes direct integrations with multiple banks.

Why it Matters

Nigeria still has tens of millions outside formal finance despite notable gains in inclusion. Light-weight, familiar interfaces can close the gap faster than heavyweight apps. Analysts point out that chat-based transfers may outperform QR codes locally, where technical know-how and fraud fears have slowed uptake. The modality also works on low-end phones and patchy networks—critical for mass-market reach.

The Competitive Lane

WhatsApp-enabled payments aren’t empty terrain. Owo (by Mono) is a visible peer. But Xara’s differentiation is its personal-assistant feel: talk, snap, or voice-note; let the bot confirm and execute; then ask it to analyze your week’s spending—all in one place. The company’s roadmap adds savings features, more billers, and light commerce (“order food,” “book dispatch”), aiming to become a unified chat wallet.

The Road Ahead

The to-do list is classic fintech:

• Bank partnerships & uptime to handle scale.

• KYC/AML rigor as volumes grow.

• User education on PIN hygiene, chat locks, and scam awareness.

• Language expansion to serve customers in Hausa, Yoruba, and beyond.

Adewale’s north star is a broader African reach wherever WhatsApp is dominant. The bet is that the most powerful fintech in emerging markets may not be another shiny app—but a reliable contact in your chat list that moves money as quickly as you think it.

Xara is a distinctly Nigerian answer to a global problem, making digital money feel effortless. If it nails reliability and trust at scale, sending cash in Nigeria could soon be as casual as saying “abeg, run it.”